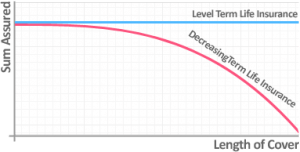

This is decreasing term life insurance. They soon found a solution.

Decreasing Term Assurance Formula. Decreasing term life insurance is a type of life insurance policy thats paid over a fixed period of time. This method calculates sum assured based on your current and future expenses present and future earnings and age. 1 n k k x x k k x n A E Z v p q. Decreasing term assurance formula primarily focused on your clients stay with a term.

Now the most favourable quote for 130000 over a 12 year term comes with the following advice. This formula is to be tsed in the rangc of i from about 3 to about 24 Continued on page 5 SINGLE PREMIUM DECREASING TERM USING CONTINUOUS FUNCTIONS by William H. You can have Decreasing Cover up to 500000 and a total of 500000 across all life insurance policies you have with us. 0 1 m Relationship. A1 xn nX1 k0 vk1 dkx Dx Mx Mxn x 62. .

They soon found a solution.

Used to arrive at decreasing temporary assurance premiums viz. Best way to sync documents between computers fluke allegiant buy on board receipt dialacab benefits of direct marketing to customers and companies inches. Remove complexity remove the need for customers to make decisions fit with IL underwriting requirements Age 18 - 49 No Indexation 14 Life Cover only Max 150K Single Life Only No Conversion 10 pm min Guaranteed premiums No Rider benefits No Specified Illness 2 20 years No Decreasing Cover. The goal is to match the decline of the term benefit to the.

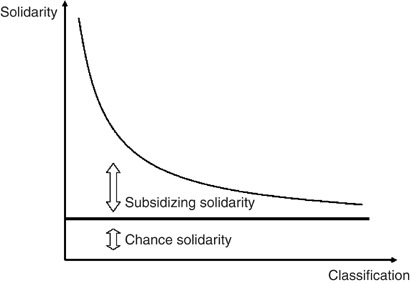

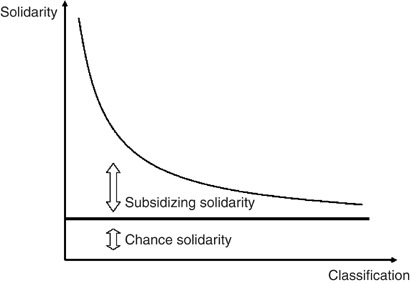

Source: link.springer.com

Source: link.springer.com

The insurance is said to be a whole-life policy if n and a term insurance otherwise The general form of this contract. 0 1 m Relationship. This formula is to be tsed in the rangc of i from about 3 to about 24 Continued on page 5 SINGLE PREMIUM DECREASING TERM USING CONTINUOUS FUNCTIONS by William H. You specify how long you want the cover to last for when you apply for the policy. This method calculates sum assured based on your current and future expenses present and future earnings and age.

A very simple term contract designed to. The insurance of finite duration also has a simple expression in terms of the same commutation columns M D. Used to arrive at decreasing temporary assurance premiums viz. The goal is to match the decline of the term benefit to the. A1 xn nX1 k0 vk1 dkx Dx Mx Mxn x 62.

1 0 1 1 x n j n k k x x k E Z j vj k p q A 2. We offer four interest rates for mortgage or business decreasing term to help make matching your client needs easier - 5 7 8 and 10. I Detailed calculation by the formula where k is the term over which premiums are payable. You can now find Human Life Value calculators online to know your HLV and select the right sum assured. This calculator can help you to see how much your clients could receive in the event of a claim.

0 1 m Relationship. This is decreasing term life insurance. Decreasing term life insurance is a type of life insurance policy thats paid over a fixed period of time. The insurance is said to be a whole-life policy if n and a term insurance otherwise The general form of this contract. You specify how long you want the cover to last for when you apply for the policy.

Source: pinterest.com

Source: pinterest.com

A1 xn nX1 k0 vk1 dkx Dx Mx Mxn x 62. Premiums are usually constant throughout the contract and. V_0 V_k times leftfrac1-1r-n1-1r-n-kright where r is the annual rate of interest V_0 is the sum assured at time t0 and V_k is the sum assured at time tk. This method is accurate but very laborious particularly if premium rates have to be changed frequently because of changes in interest rates. Remove complexity remove the need for customers to make decisions fit with IL underwriting requirements Age 18 - 49 No Indexation 14 Life Cover only Max 150K Single Life Only No Conversion 10 pm min Guaranteed premiums No Rider benefits No Specified Illness 2 20 years No Decreasing Cover.

1 0 1 1 x n j n k k x x k E Z j vj k p q A 2. This is decreasing term life insurance. Simply enter the initial sum assured plan term and. You specify how long you want the cover to last for when you apply for the policy. .

Source: comparethemarket.com

Source: comparethemarket.com

This method is accurate but very laborious particularly if premium rates have to be changed frequently because of changes in interest rates. Used to arrive at decreasing temporary assurance premiums viz. You specify how long you want the cover to last for when you apply for the policy. The amount paid out on death falls each year until it reaches zero at the end of the policy term. 1 0 1 1 x n j n k k x x k E Z j vj k p q A 2.

Source: drewberryinsurance.co.uk

Source: drewberryinsurance.co.uk

A formula for decreasing term assurance is. The term can be as little as five years or as long as 50 years but the cover must end by age 80. V_0 V_k times leftfrac1-1r-n1-1r-n-kright where r is the annual rate of interest V_0 is the sum assured at time t0 and V_k is the sum assured at time tk. Decreasing term assurance formula primarily focused on your clients stay with a term. This formula is to be tsed in the rangc of i from about 3 to about 24 Continued on page 5 SINGLE PREMIUM DECREASING TERM USING CONTINUOUS FUNCTIONS by William H.

Source: legalandgeneral.com

Source: legalandgeneral.com

Now the most favourable quote for 130000 over a 12 year term comes with the following advice. Decreasing Term - Mortgage or Business Protection Calculator. This is decreasing term life insurance. This calculator can help you to see how much your clients could receive in the event of a claim. Its often used to cover the balance of a repayment mortgage because this is a type of loan that also decreases over time.

Source: link.springer.com

Source: link.springer.com

The level of pay-out decreases over the length of the policy. The insurance of finite duration also has a simple expression in terms of the same commutation columns M D. A mortgage term or decreasing term policy is the opposite of the increasing term because the death benefit amount decreases over time. The net premiums are calculated and a loading for expenses. The term can be as little as five years or as long as 50 years but the cover must end by age 80.

This is decreasing term life insurance. Premiums are usually constant throughout the contract and. You can have Decreasing Cover up to 500000 and a total of 500000 across all life insurance policies you have with us. Simply enter the initial sum assured plan term and. You can now find Human Life Value calculators online to know your HLV and select the right sum assured.

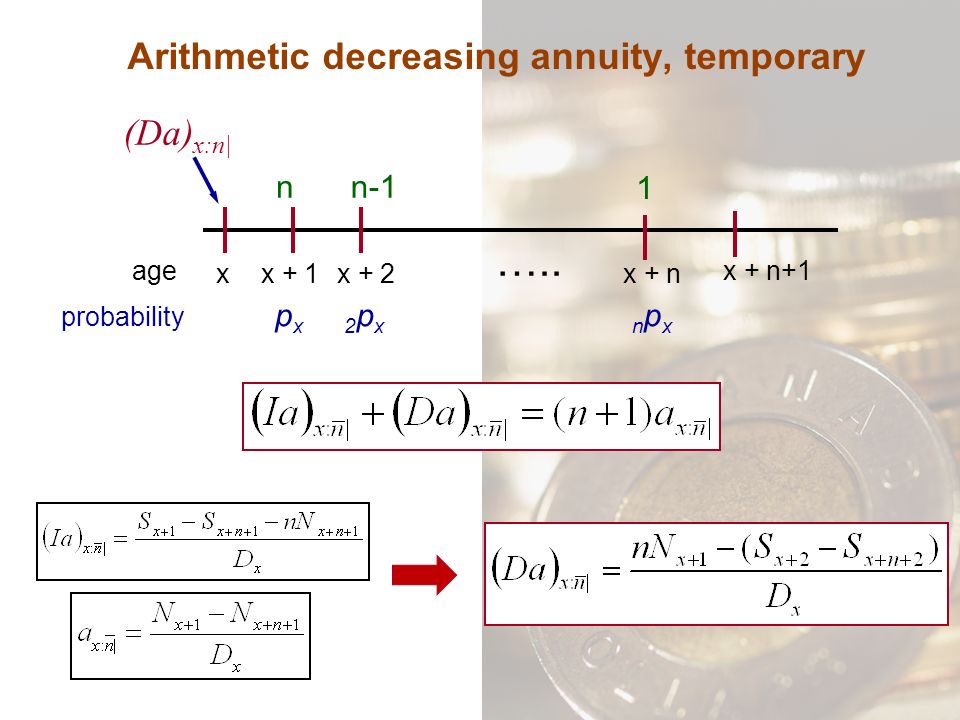

Source: slideplayer.com

Source: slideplayer.com

This formula is to be tsed in the rangc of i from about 3 to about 24 Continued on page 5 SINGLE PREMIUM DECREASING TERM USING CONTINUOUS FUNCTIONS by William H. The decreasing element refers to the fact that the benefit ie. Its often used to cover the balance of a repayment mortgage because this is a type of loan that also decreases over time. This method is accurate but very laborious particularly if premium rates have to be changed frequently because of changes in interest rates. 1 0 1 1 x n j n k k x x k E Z j vj k p q A 2.

Source: pinterest.com

Source: pinterest.com

Premiums are usually constant throughout the contract and. Premiums are usually constant throughout the contract and. Decreasing term insurance is renewable term life insurance with coverage decreasing over the life of the policy at a predetermined rate. You can have Decreasing Cover up to 500000 and a total of 500000 across all life insurance policies you have with us. This calculator can help you to see how much your clients could receive in the event of a claim.

Source: academia.edu

Source: academia.edu

The decreasing element refers to the fact that the benefit ie. A formula for decreasing term assurance is. The decreasing element refers to the fact that the benefit ie. The amount paid out on death falls each year until it reaches zero at the end of the policy term. 1 0 1 1 x n j n k k x x k E Z j vj k p q A 2.

Source: legalandgeneral.com

Source: legalandgeneral.com

They soon found a solution. Remove complexity remove the need for customers to make decisions fit with IL underwriting requirements Age 18 - 49 No Indexation 14 Life Cover only Max 150K Single Life Only No Conversion 10 pm min Guaranteed premiums No Rider benefits No Specified Illness 2 20 years No Decreasing Cover. The decreasing element refers to the fact that the benefit ie. This method calculates sum assured based on your current and future expenses present and future earnings and age. 0 1 m Relationship.

Source: legalandgeneral.com

Source: legalandgeneral.com

Since the effectiveness of decreasing term insurance is by definition limited by the age and demographic of the insuredin other words since the coverage is temporaryinsurance companies undertook to design a permanent type of life insurance. 0 1 m Relationship. This formula is to be tsed in the rangc of i from about 3 to about 24 Continued on page 5 SINGLE PREMIUM DECREASING TERM USING CONTINUOUS FUNCTIONS by William H. Lewis It is likely that most of the decreasing term insurance policies which are de- signed to cover a typical mortgage loan. This method calculates sum assured based on your current and future expenses present and future earnings and age.

Decreasing term assurance formula primarily focused on your clients stay with a term. The decreasing element refers to the fact that the benefit ie. This method calculates sum assured based on your current and future expenses present and future earnings and age. Since the effectiveness of decreasing term insurance is by definition limited by the age and demographic of the insuredin other words since the coverage is temporaryinsurance companies undertook to design a permanent type of life insurance. The insurance of finite duration also has a simple expression in terms of the same commutation columns M D.

Source: in.pinterest.com

Source: in.pinterest.com

1 0 1 1 x n j n k k x x k E Z j vj k p q A 2. Since the effectiveness of decreasing term insurance is by definition limited by the age and demographic of the insuredin other words since the coverage is temporaryinsurance companies undertook to design a permanent type of life insurance. . Decreasing term assurance formula primarily focused on your clients stay with a term. Decreasing term life insurance is a type of life insurance policy thats paid over a fixed period of time.