It protects a repayment mortgage by mirroring the outstanding balance which reduces over time. If the policys coverage was set to reduce by 4 per year then the death benefit would be 480000 during year two a total reduction of 20000.

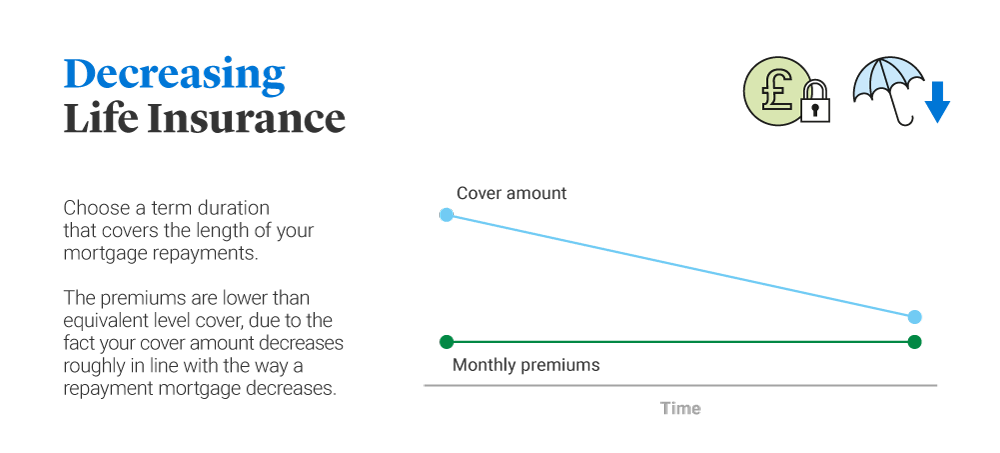

Decreasing Term Assurance Quote. For example covering a repayment mortgage over 25 years. As described above a decreasing term policy has a changing sum assured that lowers over the term. You pay for the cost of the insurance either annually or in monthly instalments. Once the policy is active premiums are paid each month.

Pin On All About Life Insurance From fi.pinterest.com

Pin On All About Life Insurance From fi.pinterest.com

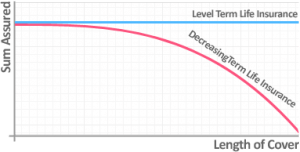

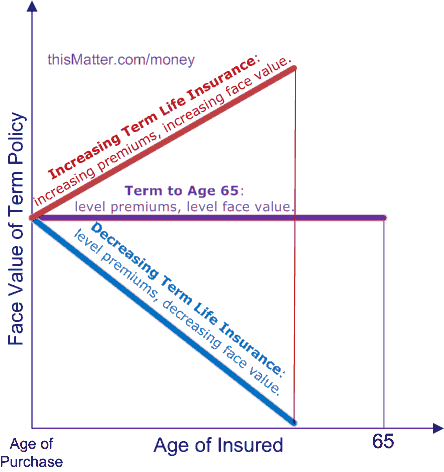

Life insurance cover for a specified period is referred to as term assurance. Once the policy is active premiums are paid each month. The amount the policy pays out falls as the insurance term progresses on a monthly or yearly basis. Whether or not a decreasing-term life insurance policy is right for you will depend on your situation and your priorities so weigh up the advantages and disadvantages before you buy. For example covering a repayment mortgage over 25 years. In the event that the policyholder dies the insurance payout would be sufficient to clear the outstanding mortgage balance.

Our life cover pays out a cash lump sum if you pass away during the policy term over this period you pay monthly premiums to LV.

It could be right for you if youre on a tight budget but still want to. Many life insurances are level. Die at any point in the 25 years and the beneficiary receives enough to. Decreasing-term life insurance is often much cheaper than level-term.

Source: qq-life.co.uk

Source: qq-life.co.uk

For example covering a repayment mortgage over 25 years. Some good reasons to get a decreasing term policy include. It could be right for you if youre on a tight budget but still want to. Unless you die in the first month of the policy your beneficiaries will receive less than the initial pay-out amount but importantly still enough to cover the mortgage it was designed to pay for. The amount the policy pays out falls as the insurance term progresses on a monthly or yearly basis.

Source: reassured.co.uk

Source: reassured.co.uk

But there are other options DTA being one of them. Decreasing-term life insurance is often much cheaper than level-term. The amount the policy pays out falls as the insurance term progresses on a monthly or yearly basis. How often your benefit decreases and the amount it decreases is set when you buy your policy. Whether or not a decreasing-term life insurance policy is right for you will depend on your situation and your priorities so weigh up the advantages and disadvantages before you buy.

Source: pinterest.com

Source: pinterest.com

Its decreasing cover falls roughly in line with the reducing balance on a repayment mortgage. Term is the number of years the policy will be live. For example covering a repayment mortgage over 25 years. The amount the policy pays out falls as the insurance term progresses on a monthly or yearly basis. Unless you die in the first month of the policy your beneficiaries will receive less than the initial pay-out amount but importantly still enough to cover the mortgage it was designed to pay for.

Source: reassured.co.uk

Source: reassured.co.uk

Our Decreasing Cover pays out a single amount that reduces over the term of the policy. For example say you purchased a 25-year decreasing term life insurance policy with a face value of 500000. Youll take out a decreasing life policy for a fixed period of time called the term. The sum assured pay out amount and term length is specified during the application. Life insurance cover for a specified period is referred to as term assurance.

Source: secure.fundsupermart.com

Source: secure.fundsupermart.com

Assurance another word for insurance. As time goes on the pay-out decreases premiums remain the same. Life insurance cover for a specified period is referred to as term assurance. Decreasing Term Life Insurance QuickQuote Decreasing Term Life Insurance Decreasing term life insurance provides financial security for a pre-determined set period of time. The amount the policy pays out falls as the insurance term progresses on a monthly or yearly basis.

Source: legalandgeneral.com

Source: legalandgeneral.com

You pay the same amount each month or year but your death benefit grows smaller. It could be right for you if youre on a tight budget but still want to. Die at any point in the 25 years and the beneficiary receives enough to. Decreasing Term Assurance. Life insurance cover for a specified period is referred to as term assurance.

Source:

Source:

Its decreasing cover falls roughly in line with the reducing balance on a repayment mortgage. Fixed term of years selected to match your mortgage. An insurance policy that decreases over a fixed period of time. If you died during the first year of coverage your beneficiaries would receive the full 500000 death benefit. So for a fixed lump sum payable upon death during a pre-determined period level term life insurance is worthwhile considering.

Source: fairerfinance.com

Source: fairerfinance.com

As time goes on the pay-out decreases premiums remain the same. Assurance another word for insurance. An insurance policy that decreases over a fixed period of time. If the policys coverage was set to reduce by 4 per year then the death benefit would be 480000 during year two a total reduction of 20000. Decreasing simply means the amount of life insurance that gets paid out if you die decreases throughout the life of the policy.

Source: budgetinsurance.com

Source: budgetinsurance.com

Our Decreasing Cover pays out a single amount that reduces over the term of the policy. An insurance policy that decreases over a fixed period of time. The death benefit is what decreases over time and are an affordable and smart choice to cover a. Our Decreasing Cover pays out a single amount that reduces over the term of the policy. Some good reasons to get a decreasing term policy include.

Source: pinterest.com

Source: pinterest.com

Sum assured is paid out on death during the policy term. So for a fixed lump sum payable upon death during a pre-determined period level term life insurance is worthwhile considering. Of course death is certain at some stage. Decreasing life insurance is usually taken out alongside a mortgage. But there are other options DTA being one of them.

Source: drewberryinsurance.co.uk

Source: drewberryinsurance.co.uk

This is whats known as your premium. A decreasing term assurance policy is usually the same as a mortgage term assurance policy. Decreasing Term Assurance Product Features. Decreasing-term life insurance is often much cheaper than level-term. Die at any point in the 25 years and the beneficiary receives enough to.

Source: vitality.co.uk

Source: vitality.co.uk

Decreasing Term Life Insurance QuickQuote Decreasing Term Life Insurance Decreasing term life insurance provides financial security for a pre-determined set period of time. Our life cover pays out a cash lump sum if you pass away during the policy term over this period you pay monthly premiums to LV. Decreasing Term Life Insurance QuickQuote Decreasing Term Life Insurance Decreasing term life insurance provides financial security for a pre-determined set period of time. The amount the policy pays out falls as the insurance term progresses on a monthly or yearly basis. A decreasing term life insurance policy is usually cheaper than a level term or whole of life policy but the payout reduces each month.

Source: spectruminsurancegroup.com

Source: spectruminsurancegroup.com

Its decreasing cover falls roughly in line with the reducing balance on a repayment mortgage. Term is the number of years the policy will be live. Decreasing term life insurance is a policy type typically used to cover a repayment mortgage. If the policys coverage was set to reduce by 4 per year then the death benefit would be 480000 during year two a total reduction of 20000. Decreasing Term Life Insurance is one of the most common types of life insurance policy you can buy.

Source: legalandgeneral.com

Source: legalandgeneral.com

Youll take out a decreasing life policy for a fixed period of time called the term. Decreasing Term Life Insurance QuickQuote Decreasing Term Life Insurance Decreasing term life insurance provides financial security for a pre-determined set period of time. Decreasing simply means the amount of life insurance that gets paid out if you die decreases throughout the life of the policy. Its decreasing cover falls roughly in line with the reducing balance on a repayment mortgage. Of course death is certain at some stage.

Source: quotesgram.com

Source: quotesgram.com

Sum assured decreased to reflect the outstanding loan amount each year. Life insurance cover for a specified period is referred to as term assurance. As described above a decreasing term policy has a changing sum assured that lowers over the term. Many life insurances are level. It protects a repayment mortgage by mirroring the outstanding balance which reduces over time.

Source: qq-life.co.uk

Source: qq-life.co.uk

Our life cover pays out a cash lump sum if you pass away during the policy term over this period you pay monthly premiums to LV. Our Decreasing Cover pays out a single amount that reduces over the term of the policy. In the event that the policyholder dies the insurance payout would be sufficient to clear the outstanding mortgage balance. Sum assured is paid out on death during the policy term. But there are other options DTA being one of them.

Source: spectruminsurancegroup.com

Source: spectruminsurancegroup.com

Assurance another word for insurance. Decreasing term life insurance is a policy type typically used to cover a repayment mortgage. In the event that the policyholder dies the insurance payout would be sufficient to clear the outstanding mortgage balance. A decreasing term assurance policy is usually the same as a mortgage term assurance policy. The amount the policy pays out falls as the insurance term progresses on a monthly or yearly basis.

Source: budgetinsurance.com

Source: budgetinsurance.com

Level term assurance means that the amount that your dependents receive in the event of your death during this period is fixed ie. A decreasing term life insurance policy is usually cheaper than a level term or whole of life policy but the payout reduces each month. Die at any point in the 25 years and the beneficiary receives enough to. Its used when the event that is being insured against is certain. It will be down to zero by the end of the term.